Click to watch – Dr Boyce in a heated argument with Ben Ferguson over taxation of the rich

Monday, August 23, 2010

Saturday, July 10, 2010

Dr. Boyce and Chris Metzler on CNBC Debating the Rich vs. the Poor

Watch Dr. Boyce Watkins and Christopher Metzler on CNBC - should the rich be taxed more than the poor? Click here to watch

Visit our Other Blogs and Join Our Family!

Scholarship in Action at Syracuse University

The Whitman School of Management

Follow us on Twitter!

Monday, March 22, 2010

The latest in Financial News - 3/22/10

India delivers growth for Domino's Pizza

Chain's new CEO expects international sales to surpass those in U.S. in 3-5 years.

- N.Y. police agree driver error caused Prius crash

- No recession for rich: Tiffany 4Q profit quadruples

- Greece may turn to IMF as Germany balks at euro aid

- Geithner: Bank overhaul must protect consumers

- Column: Health care bill should help small business

Friday, March 12, 2010

How Much Dough is Earned in March Madness Anyway?

In 2006, the chairman of the House Ways and Means Committee, Bill Thomas, sent a letter to NCAA President, Myles Brand. In this letter, Thomas had this to say:

"The annual return also states that one of the NCAA's purposes is to 'retain a clear line of demarcation between intercollegiate athletics and professional sports.' Corporate sponsorships, multimillion dollar television deals, highly paid coaches with no academic duties, and the dedication of inordinate amounts of time by athletes to training lead many to believe that major college football and men's basketball more closely resemble professional sports than amateur sports."

In this letter, Thomas makes a very clear point that is also being mentioned by academics, coaches, former athletes, students, attorneys and fair-minded Americans throughout the country: the NCAA is a professional sports league. To call collegiate athletes in revenue-generating sports "amateur" is like calling Barack Obama a part-time politician in training.

Companies pay CBS Sports $100,000 dollars for a 30-second ad during the early rounds of March Madness. This cost jumps to $1 million dollars for a 30-second spot during the Final Four. The NCAA's contract with CBS is an 11-year, $6.1 billion dollar TV rights deal, with the NCAA hauling in over half a billion per year in revenue. The amount of money made during March Madness exceeds that which is earned in the playoffs for the NFL, NBA or Major League Baseball. The average coach in March Madness earns roughly $1 million dollars per year and schools typically hire their basketball coaches without giving a "you-know-what" about the academic standards of the coach they've chosen to hire (you hear that Kentucky)?

Now, who said that any of this could be defined as "amateur"?

Thursday, March 11, 2010

Dr. Boyce: Why African Americans are More Optimistic than you Think

According to a recent survey by Experian, African-American consumption grew by over 50 percent from the year 2000 to 2008 ($590 billion to $913 billion), and it is expected to grow to over $1.2 trillion dollars by the year 2013. The study also shows that blacks are more economically optimistic than whites, with 36 percent of us stating that we expect our financial future to improve, as opposed to 31 percent for all adults.

The Experian study says a couple of things: First, it says that black people love to consume and that we are getting better at it. In fact, black people have historically been very good at buying things and working hard to get them, but we are not very good at production, investment and saving our money. We grab our tax refunds and run to the mall. We become highly paid corporate lawyers in order to purchase the house and car we really can't afford. We are chubby kids in the economic candy store, accelerating our collective addiction to the monetary engines controlled by corporate greed.

Wednesday, February 17, 2010

Dr. Boyce: Russell Simmons Rants on Banks

Hip hop mogul Russell Simmons seems to feel that banks are not treating the poor in a proper fashion. This week, in a rant on his site, “The Global Grind,” Simmons had this to say:

“They trick customers into doing things that are not good for them through lack of transparency, and surprise them with new fees when they can least afford it. I’m learning an important lesson about ethics or lack of ethics in this industry. In fact, I’m fighting with a bank right now that doesn’t know what kind of ass whipping they are going to get when I expose them for the abusive practices and exuberant fees they are charging the poor. What they are doing is trying to double their already outrageously high fees in exchange for providing absolutely nothing to my customers.”

Simmons went on to try to create a “movement” by adding a call to action:

“Let’s start the biggest public discussion ever about how banks treat us and expose these banks for their unequal treatment and unconscionable conduct. The time is now.”

Tuesday, February 16, 2010

The Economic Policy Institute – 2/16/10

12/07/09

American Indians and the Great Recession—Economic Disparities Growing Larger

Issue Brief

11/12/09

Getting Good Jobs to People of Color

Briefing Paper

07/21/09

Unequal unemployment—Racial disparities in unemployment vary widely by state

Issue Brief

03/09/09

Stuck in Neutral: Economic Gains Stall Out for Asian Americans and Pacific Islanders in 2000s

Briefing Paper

10/31/08

Hispanics and the economy: Economic stagnation for Hispanic American workers, throughout the 2000s

Briefing Paper

09/18/08

Reversal of fortune: Economic gains of 1990s overturned for African Americans from 2000-07

Briefing Paper

01/18/08

What a recession means for black America

Issue Brief

Web-only Content

Date

Title

Type

12/16/09

A bleak future for black children

Analysis & Opinion

12/09/09

High unemployment: A fact of life for American Indians

Economic Snapshots

11/12/09

Reversing the Decline in Good Jobs [event]

Other

11/10/09

Jobs creation effort needs to focus on good jobs

Economic Snapshots

09/18/09

Three lessons about black poverty

Analysis & Opinion

07/08/09

African Americans see weekly wage decline

Economic Snapshots

04/22/09

Among college-educated, African Americans hardest hit by unemployment

Economic Snapshots

09/05/08

Jobs Picture, September 5, 2008 - Special Issue

Economic Indicators

08/04/08

Understanding the black jobs crisis

Viewpoints

06/10/08

Subprime mortgages are nearly double for Hispanics and African Americans

Monday, February 15, 2010

Congressional Black Caucus “Funny Money”

From left are, Rep. Donald Payne, D-N.J., Rep. John Lewis, D-Ga., Rep. Edolphus Towns, D-N.Y. and Rep. Charles Rangel D-NY. (AP Photo/Pablo Martinez Monsivais, File)

Does anyone think that the Congressional Black Caucus works for the interests of the African-American community? Well, think again. It appears that, according to a scathing report in The New York Times, African-Americans don't have the money to buy the CBC's loyalty. At the very least, they do not appear to be the top priority for a legislative group that has allowed dollar signs to complicate its priorities.

The New York Times article details a highly suspicious network of foundations and charities that seem to funnel money to CBC members in exchange for influence in Washington. The political and charitable wings of the CBCtook in $55 million dollars between 2004 and 2008, with only $1 million of that coming through their political action committee; the rest came through their unregulated network of foundations, which are allowed to escape campaign finance laws designed to keep legislators from being bought by corporate America.

While the CBC argues that the funds are used to support charitable causes in the African-American community, it seems that the foundation spends more time "big balling" with elaborate corporate events than it spends actually doing work for the community. Federal tax records show that the CBC Foundation spent more money on the caterer for its annual dinner, $700,000 dollars, than it spent giving out scholarships. As my mama used to say, "That's just trifling."

Even more disturbing are the relationships that the Congressional Black Caucus has formed with industries that clearly do not have the interests of the black community at heart, including the Internet poker industry, cigarette manufacturers, alcoholic beverage producers and rent-to-own companies. Many rent-to-own companies operate in predominantly black neighborhoods and are effectively electronic drug dealers: They give consumers a quick high today in exchange for unethically high fees and massive amounts of debt. Well guess what? The CBC is one of the reasons that the rent-to-own industry has been allowed to expand its operations in urban communities where CBC members don't even live.

Friday, February 5, 2010

Wednesday, February 3, 2010

Black News: Homeowners Walking Away from Mortgages

updated 12:25 a.m. ET, Wed., Feb. 3, 2010

In 2006, Benjamin Koellmann bought a condominium in Miami Beach. By his calculation, it will be about the year 2025 before he can sell his modest home for what he paid. Or maybe 2040.

“People like me are beginning to feel like suckers,” Mr. Koellmann said. “Why not let it go in default and rent a better place for less?”

After three years of plunging real estate values, after the bailouts of the bankers and the revival of their million-dollar bonuses, after the Obama administration’s loan modification plan raised the expectations of many but satisfied only a few, a large group of distressed homeowners is wondering the same thing.

Thursday, January 21, 2010

Charges Filed in NAACP Embezzlement Case

A former NAACPexecutive was charged in Fulton County, Ga., with embezzling $275,000 from the U.S. civil rights organization, NAACP officials say.

The Rev. Amos Brown, administrator for the NAACP's Atlanta chapter, said former NAACP official Judith W. Hanson and Hanson's former assistant, Saundra Douglass, are accused of embezzling funds during their time with the Baltimore-based organization, The Atlanta Journal-Constitution said Tuesday.

Authorities allege Hanson, who served as the executive director of the NAACP's Atlanta chapter, and Douglass used NAACP funds for personal expenses during a six-year period.

Wednesday, January 20, 2010

African American News: Study Finds Financial Benefits to Marriage

Historically, marriage was the surest route to financial security for women. Nowadays it's men who are increasingly getting the biggest economic boost from tying the knot, according to a new analysis of census data.

The changes, summarized in a Pew Research Center report being released Tuesday, reflect the proliferation of working wives over the past 40 years — a period in which American women outpaced men in both education and earningsgrowth. A larger share of today's men, compared with their 1970 counterparts, are married to women whose education and income exceed their own, and a larger share of women are married to men with less education and income.

"From an economic perspective, these trends have contributed to a gender role reversal in the gains from marriage," wrote the report's authors, Richard Fry and D'Vera Cohn.

Tuesday, January 19, 2010

Facebook Plagued by Fake Haiti Fundraisers

Fake fundraising efforts for the Haiti disaster are spreading like wildfire on Facebook. Dozens of fan pages have been set up, urging users to join and promising a $1 donation for each member. One group this weekend attracted 1.5 million members before it was disabled.

Meanwhile, during the weekend, Facebook officials had to beat back a rumor that the firm had promised a $1 donation for every member that changed their status to include a message about Haiti.

"This status is being tracked, the owners of facebook have confirmed they will send $1 to the rescue fund for the Haiti earthquake disaster for everytime this is cut and paste as a status," read one form of the bogus claim. "You only have to leave it for a minimum of 1 hour. Lets all do our bit to help."

Facebook spokesman Barry Schnitt said the firm took aggressive steps to quell the rumor. It posted a note on its blog on Saturday warning about the bogus message.

"Beware of scams and hoaxes and ensure that your donations for Haiti get to the right places," the social networking company wrote on its blog. Contrary to a current meme, Facebook is not donating $1 for statuses, however we are sharing reputable resources via the "Other Pages" tab on the Global Disaster Relief on Facebook Page."

Saturday, January 16, 2010

Wyclef’s Charity Under Questioning

Haiti's musician Wyclef Jean, left, arrives at the airport in Port-au-Prince on Wednesday, Jan. 13, 2010, the day after a 7.0-magnitude earthquake hit his country. (AP Photo/Lynne Sladky)

(AP)

Groups that vet charities are raising doubts about the organization backed by Haitian-born rapper Wyclef Jean, questioning its accounting practices and ability to function in earthquake-hit Haiti.

Even as more than $2 million poured into The Wyclef Jean Foundation Inc. via text message after just two days, experts questioned how much of the money would help those in need.

"It's questionable. There's no way to get around that," said Art Taylor, president and chief executive of the Better Business Bureau's Wise Giving Alliance, based in Arlington, Va.

Taylor reviewed Internal Revenue Service tax returns for the organization also known as Yele Haiti Foundation from 2005 through 2007. He said the first red flag of poor accounting practices was that three years of returns were filed on the same day — Aug. 10 of last year.

In 2007, the foundation's spending exceeded its revenues by $411,000. It brought in just $79,000 that year.

click to read.Thursday, January 14, 2010

US Insurers Have Limited Exposure to Haiti

U.S. insurers may have very little exposure to the massive losses caused by the earthquake that struck Haiti.

Haiti is one of the smallest insurance markets in the Americas, with a total non-life insurance premium income of just under $20 million, "which reflect the country's poverty," according to a report Wednesday from Newark, Calif.-based Risk Management Solutions Inc. By comparison, the total net premiums for property and casualty coverage in the U.S. in 2008 totaled nearly $441 billion, the most recent figures available from the Insurance Information Institutes 2010 Fact Book.

Saturday, January 9, 2010

Your Financial News: Jobs Come and then Go

By Chris Isidore, senior writerJanuary 8, 2010: 11:31 AM ET

By Chris Isidore, senior writerJanuary 8, 2010: 11:31 AM ET

NEW YORK (CNNMoney.com) -- Employers once again slashed a substantial number jobs off their payrolls in December, according to adisappointing report from the government Friday. But there was a small glimmer of hope as well.

The payroll number for November was revised to a net gain of 4,000 jobs. That's the first increase in jobs in nearly two years. The government had previously indicated that 11,000 jobs were lost in November.

Click to read.Thursday, January 7, 2010

Your Black News: Black Leaders Fight for Census Funds

The nation’s black newspaper executives are asking for $10 million from the U.S. Census Bureau to advertise for the 2010 Census, but the government is reportedly only offering $2.5 million.

NNPA officials told Richard Prince - who writes a diversity column for The Robert C. Maynard Institute for Journalism Education - that the NNPA would use the $10 million in advertising to encourage African Americans across the country to participate in the 2010 Census.

Commerce officials said the Census Bureau would take a second look at its $300 million communications campaign to determine if there are ways to make it better. The bureau kicks off its ad campaign next month and will conduct its head count via mail and door-to-door canvassing next spring.

Last month, a coalition of civil rights leaders met with U.S. Commerce Secretary Gary Locke in an effort to prevent an undercount of African-Americans in the upcoming 2010 Census. In 2000, the Census Bureau said about 4.5 million people were mistakenly overlooked - mostly African Americans and Hispanics.

Monday, December 21, 2009

Dr. Boyce Money – The Latest – 12/21/09

-

How a Happy Meal Can Cost You Half a Million Dollars

Many of us don't spend much time thinking about retirement planning. We figure that it's something ...

-

Sinbad: Comedian Files for Bankruptcy After Going Broke

It turns out that Sinbad is broke. The comedian declared bankruptcy on December 11th of this year, ...

-

Man Gambles Away $127 Million Dollars - Dr. Boyce Money

Terrance Watanabe has a serious problem. The 52-year old man went into Harrah's casino, got drunk ...

-

Gatorade Drops Tiger Woods Drink: Dr. Boyce Money

Gatorade has dropped Tiger Woods, well, at least they dropped his drink. The new Gatorade drink, ...

-

Prosperity Gospel and the Black Church: Legitimate or Not?

Nearly every African American knows just how important the black church is to our community. We ...

-

Inner City Schools: Funding Should be Equal Across the Board

The following is an excerpt from the book, "Black American Money." I saw some random "expert" on a ...

Monday, December 14, 2009

Accenture Drops Tiger Woods

A major sponsor for Tiger Woods announced Sunday that it is dropping the golf star in light of recent controversy swirling around his personal life.

Accenture, a management consulting firm, said on its Web site that "given the circumstances of the last two weeks ... the company has determined that he is no longer the right representative for its advertising."

The move ends a sponsorship arrangement that lasted six years.

Another major sponsor, Gillette, said Saturday it was "limiting" Woods' role in its marketing programs to give him the privacy to work on family relationships.

Woods announced on his own Web site Friday that he is taking an "indefinite break" from professional golf.

The 33-year-old golfer, who tops the sport's world rankings, has been mired in controversy since he crashed his car outside his Florida mansion late last month. In the week following the crash, Woods apologized for "transgressions" that let his family down, and US Weekly magazine published a report alleging that Woods had an affair with a 24-year-old cocktail waitress named Jaimee Grubbs.

Sunday, December 13, 2009

News: Tiger Loses $180 Million if He Takes a Year Off?

According to the New York Post, this is how much Tiger stands to lose if he takes the year off:

$180 MILLION IN PERSONAL EARNINGS, INCLUDING:

$110 million in advertising income, if sponsors rebel and dump contracts

$23 million in tournament prize money (roughly the amount he won in his last full season on the PGA Tour and abroad)

$30 million in fees for three golf courses he’s designing, if deals fall through

$17 million in appearance fees (equal to his best year for showing up to play minor events)

$591 MILLION IN INDUSTRY LOSSES, INCLUDING:

$455 million in losses to his Nike-endorsed golf brand, based on estimated 35 percent sales decline

$40 million in lost PGA Tour ticket sales, based on a predicted 25 percent loss at 20 Woods-attended tourneys

$96 million if the Woods-brand EA Sports golf video game goes down the tubes

Read more: http://www.nypost.com/p/news/national/tiger_to_suffer_ashEvFQnFsG4EKGuaCCDML#ixzz0ZaM5sD5W

Thursday, December 10, 2009

Man Loses $127 Million Dollars at Casino

During a year-long gambling binge at the Caesars Palace and Rio casinos in 2007, Terrance Watanabe managed to lose nearly $127 million.

The run is believed to be one of the biggest losing streaks by an individual in Las Vegas history. It devoured much of Mr. Watanabe's personal fortune, he says, which he built up over more than two decades running his family's party-favor import business in Omaha, Neb. It also benefitted the two casinos' parent company, Harrah's Entertainment Inc., which derived about 5.6% of its Las Vegas gambling revenue from Mr. Watanabe that year.

Terrance Watanabe, 52, is believed to have the biggest losing streak in Las Vegas history, losing $127 million dollars in one year. Mr. Watanabe, who now lives in the Bay Area, stands near the entrance to Stanford University on Dec. 3, 2009.

Today, Mr. Watanabe and Harrah's are fighting over another issue: whether the casino company bears some of the responsibility for his losses.

In a civil suit filed in Clark County District Court last month, Mr. Watanabe, 52 years old, says casino staff routinely plied him with liquor and pain medication as part of a systematic plan to keep him gambling.

Nevada's Gaming Control Board has opened a separate investigation into whether Harrah's violated gambling regulations, based on allegations made by Mr. Watanabe.

Wednesday, December 9, 2009

Tiger Woods Ads Disappear from TV

Tiger Woods is all over the TV, but his ads haven't been.

According to media tracker Nielsen, the last time a commercial featuring Tiger Woods appeared on television was Nov. 29. The 30-second Gillette ad aired during NBC's "Football Night in America," the pre-game show that broadcast prior to the Sunday night football game between the New Orleans Saints and the New England Patriots.

The ad featured Woods, New York Yankees shortstop Derek Jeter, Spanish basketball phenom Ricky Rubio and an announcer who says, "Here's to confidence," and aired eight times during November, according to Aaron Lewis, a spokesman for Nielsen.

Tuesday, December 8, 2009

UCLA Students Running into Major Financial Trouble

Watch this video, which describes the financial trauma for UCLA students as the result of a recent tuition hike.

Sunday, November 29, 2009

Dr. Boyce Watkins: How Does Prosperity Gospel Work Anyway?

by Dr. Boyce Watkins, Syracuse University, Your Black World

Nearly every African American knows just how important the black church is to our community. We also know about "prosperity gospel," the act of preaching about God within the context of wealth building. I admit that this form of faith is a bit odd to me. I am a Finance Professor and I become confused when my pastor talks about money more than I do. The saddest truth is that it's hard to tell the difference between a pastor and a pimp: Most pastors aren't pimps, but any pimp could be a pastor. The same skill set is required in both professions.

My father is a preacher, but he almost never preaches about money. I've never heard him asking for money on the pulpit, or mentioning that giving money to him is one of the keys to gaining access to heaven. But I don't presume that my father is right about all things, and given that I write about money on a regular basis, I have gained an appreciation for what financial resources can do to enhance your life. Also, one must be aware of the pragmatic realities of running a church: You have the building fund, bills to pay every month and any community service initiatives that the church chooses to pursue. The proper use of money can certainly enhance your ability to do God's work.

Wednesday, November 25, 2009

Tuesday, November 24, 2009

Sunday, November 22, 2009

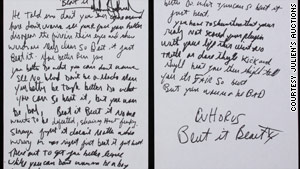

Black News: Michael Jackson Auction Fetches Big Money

New York (CNN) -- More than 80 Michael Jackson collectibles -- including the late pop star's famous rhinestone-studded glove from a 1983 performance -- were auctioned off Saturday, reaping a total $2 million.

Profits from the auction at the Hard Rock Cafe in New York's Times Square crushed pre-sale expectations of only $120,000 in sales.

The highly prized memorabilia, which included items spanning the many stages of Jackson's career, came from more than 30 fans, associates and family members, who contacted Julien's Auctions to sell their gifts and mementos of the singer.

Jackson's flashy glove was the big-ticket item of the night, fetching $420,000 from a buyer in Hong Kong, China. Jackson wore the glove at a 1983 performance during "Motown 25," an NBC special where he debuted his revolutionary moonwalk.

Click to read.Wednesday, November 11, 2009

Dr. Boyce Watkins: How Rihanna Is Profiting from Her Tragedy

by Dr. Boyce Watkins, Syracuse University

I hated what Chris Brown did to Rihanna. I was angered, disappointed and irritated by the fact that many are quick to forgive egregious behavior on the part of celebrities, and a hit song can forgive all sins. At the same time, celebs are just like the rest of us, full of complexities that the world may never come to understand. Rihanna has walked away from Chris and she is now telling the entire world how bad of a man he is, and we're all taking her side.

The problem for Rihanna, however, is that her actions aren't making much sense.

Rihanna's recent whirlwind media tour has included the likes of ABC News, MTV and other major media outlets. Throughout this tour, she has allowed the world to enter into her dark reflection on the relationship she had with Chris Brown, with that reflection seeming to have almost no productive purpose. I am not sure why the he-say/she-say between two 19-year old kids should be the concern of the nation. But then again, I am sitting here writing about it, so I am as guilty as everyone else.

Sunday, November 1, 2009

The Fed Chairman Shows Serious Racial Ignorance

- Federal Reserve Chairman Ben S. Bernanke listens to businessmen following an address in Chatham, Mass., Friday, Oct. 23, 2009. (AP Photo/Charles Krupa)

Last spring when Federal Reserve chair Ben Bernanke visited Morehouse College, an undergraduate student asked him what accounts for the enormous racial disparity in wealth. Bernanke responded that the source of the problem was the lack of "financial literacy" and "financial education" on the part of blacks, particularly with respect to savings decisions.

He said nothing about the lack of access to inherited wealth, such as inheritances and other intergenerational transfers. Most wealth acquisition today takes place by such asset shifts. Even more astonishing, Bernanke never mentioned the notorious history of white violence that included the seizure, destruction and appropriation of black property.

Acknowledging this unfairness is not an excuse but a powerful truth; remedying it requires straightforward government action, rather than lectures on the value of saving. In fact, the racial wealth gap can be decreased - and without using a race-specific strategy of wealth redistribution.

We propose Children's Development Accounts, an expanded and non-incremental version of what Manning Marable of Columbia University has called the "Baby Bond" plan. It would provide an endowed trust fund for all children born into families with a net worth below the national median, progressively rising to $50,000 to $60,000 for children whose families are in the lowest wealth quartile. The program could be structured like the Earned Income Tax Credit, which uses a benefits phase-out schedule.

Monday, October 19, 2009

Dr Boyce Watkins: Nas and His Tax Problems – What We Can All Learn

by Dr. Boyce Watkins, AOL Black Voices

Hip Hop Wired is reporting that the rapper Nas is having some serious financial problems. In addition to owing his wife Kelis $44,000 per month in child support, it turns out that the artist also owes the federal government another $2.5 million in taxes. Here are quick thoughts about Nas, love and money:

1) Nas has a complicated life. His decision to marry the "love of his life" is going to cost him for the rest of his life. The rapper's tax situation could be due to irresponsibility (as appears to be the case with Method Man and Nicolas Cage), or it could simply be a matter of using write-offs that were not allowed by the IRS. We can't assume that Nas' tax trouble automatically makes him into a horrible citizen.

Thursday, October 15, 2009

American Express CEO Says Disaster was Averted in Money Crisis

Sunday, October 11, 2009

Economic News: Entrepreneurs Create their own Economic Recovery

Back in August, Federal Reserve officials suggested that the Great Recession was ending and the U.S. could expect "a gradual resumption of sustainable economic growth." But even with stock market indexes and the bottom lines of large financial firms bouncing back, small businesses can expect a longer slog to economic health.

"Small business performance is a lagging indicator of recovery in the same way that unemployment is," says Villanova University business school professor John Pearce II.

And it's likely that small businesses will find this recovery even slower than previous ones. The downturn has especially hurt construction firms, retailers and food service providers, the vast majority of which employ fewer than 20 workers. To make matters worse, more than 110 banks have failed since early 2008, most of them community thrifts catering to the financial needs of local firms.

Saturday, October 10, 2009

Eddie Griffin’s New Show – What it Teaches Us about Money…Nothing

by Dr. Boyce Watkins, Syracuse University, Your Black World

I had a lot of fun watching the new Vh-1 show, "Going for Broke," starring comedian Eddie Griffin. Griffin is one of the funniest comics in America, the comedian that Chris Tucker could have been (if he would simply stop disappearing between Jackie Chan movies).

On the show, Griffin gives insight into his personal life, which is both intriguing and disturbing. The show is called "Going for Broke" for a reason, because Eddie just might actually get there.

Here are some reasons that Eddie Griffin might actually become the broke celebrity that he is trying to become:

1) He spends like a damn fool. One of the easiest traps for an entertainer to fall into is the "infinite money trap." That's when the person thinks that they've got an endless supply of cash, giving them ability to spend whatever they want on whatever they want. Apparently Eddie may have fallen into this trap, since his Bentley was being repossessed in an early episode of the show. Eddie's conversation with his accountant was also revealing, as the words "all the accounts are empty" seemed to strike him hard. With all the success that Eddie Griffin has had, it is difficult to imagine that he would be completely broke. But the truth is that this kind of thing happens all the time.

If the link above doesn’t work, click here.

Tuesday, October 6, 2009

Economic News: Senate Could Vote to Extend Jobless Benefits

from AOL Black Voices

With U.S. unemployment rising, lawmakers hope to resolve a logjam this week on a measure that would extend jobless benefits for those who already may have exhausted them, Senate aides said on Tuesday.

Congressional leaders had hoped to extend benefits before the end of September, when some 400,000 recipients were expected to use them up. But while the House of Representatives last month passed a bill, jobless benefits legislation stalled in the Senate due to a dispute over how many workers should be eligible.

While some details remained unresolved, the measure could come up for a vote in the Senate within days, said an aide to Democratic Senator Jeanne Shaheen, who argued that the legislation was too narrowly targeted.

Shaheen objected to legislation passed by the House that would extend benefits for jobless workers only in states where the unemployment rate is above 8.5 percent. The unemployment rate was 6.8 percent in August in Shaheen's home state of New Hampshire.

Sunday, October 4, 2009

Fenorris Pearson Explains How to Find a Mentor in your Company

by Fenorris Pearson, CEO – Global Consumer Innovation, Inc.

Even when I was a Vice President at Dell Computers, one of the most cutting edge companies on the planet, our problems remained the same. The variables changed, but the bottom line always came down to figuring out how to sell to one customer at a time. Reaching this critical objective becomes more complex as technology changes and the world becomes more advanced. As complacent as we’ve gotten with new technology and global opportunities, this much has become clear: what got you here won’t get you there. In fact, what positioned you here, might not even keep you here…

…At least, not without a sponsor.

These days competition isn’t just stiff, it’s rigid. You need every advantage you’ve got, particularly if you’re a recent grad, female or minority. Think hard work, an MBA and a well-rounded resume will get you to the top? Think again; that might be what got you here, but to get there – the proverbial corner office or CEO’s chair – you’ll need more than just a spotless resume and a 4.0 GPA; you’ll need a sponsor.

Friday, October 2, 2009

Financial News: Consumer Bankruptcies Soar During September

Consumer bankruptcies soared 41% from the previous September and climbed from August, as high unemployment and the housing market crash took their toll, the American Bankruptcy Institute said Friday.

September filings totaled 124,790, the fourth-highest month since the bankruptcy law changed in 2005.

Filings also rose 4% from August, even as recent reports indicated the housing market might be stabilizing and consumer confidence appears to be recovering.

September's filings pushed 2009 consumer bankruptcies to 1.05 million, the highest for the first nine months of a year since 1.35 million in 2005.

The American Bankruptcy Institute said it expects consumer bankruptcies to climb to more than 1.4 million this year.

The U.S. unemployment rate rose to a 26-year high in September at 9.8%, according to government statistics released on Friday.

Monday, September 28, 2009

Financial News: Ebony and Jet Suffer Serious Financial Woes

by Dr. Boyce Watkins, MSNBC’s TheGrio.com, Your Black World, AOL Black Voices

The black journalism students here at Syracuse often come to me to find out how the industry works. They sometimes instinctively wonder if their professors' stories about being in a CBS newsroom in 1982 are going to help them survive in a world run by Twitter, Myspace and Facebook. The answer is a resounding "probably not."

While respecting the journalism professors teaching their classes, I simply use examples like Ebony Magazine to help them realize that black media is changing, and sites like theGrio.com, BlackVoices.com, and TheRoot.com, are examples of how black media has evolved. In fact, a journalist who doesn't understand technology and business models is in danger of starting his/her career as a dinosaur.

When it comes to recent reports about Ebony Magazine being offered for sale, I admit that I was saddened, but not surprised. The Ebony Fashion Fair has become one of the most celebrated events in black America, and the magazine has been nothing less than a tremendous source of national pride since its creation in 1945. But in the age of the web, oversized bureaucracies can be crushed under the weight of their own arrogance. Bloated payrolls, pompous corporate functions and a sense of entitlement make them easy prey for quick, hungry and rapidly evolving competition.

In spite of the tremendous love we have for Ebony/Jet, the truth must be confronted when realizing that it is what radio was to TV or what the train was to the airplane. Like radios and trains, there is still a place for print media, but that role is no longer dominant. The current economic climate only accelerated the inevitable, since advertisers were eventually going to stop spending $50,000 for magazine ads when they can buy the same number of eyeballs for $5,000 or less.

I present the following 5 questions I'd like to ask out loud about both Ebony Magazine and the state of African American media:

Visit Your Black World for the latest in Black News

Sunday, September 27, 2009

Thursday, September 24, 2009

Financial Alert: No Property Insurance Can Leave You Bankrupt

Your Black World, AOL Black Voices

Most of us know very little about the ins and outs of property insurance. Christopher Chestnut is not in that category. As a prominent attorney out of Florida, Mr. Chestnut has taken on multi-million dollar cases and handled some of the most complex lawsuits imaginable. As one of the leading young black attorneys in America, Chestnut has been recognized by President Obama for his outstanding accomplishments.

I spoke to Chris this week about Property Insurance and what it can do to make your life a little simpler. Here is what he had to say:

1) If you rent, make sure you have renter's insurance. Also, make sure your landlord has homeowner's insurance, since renter's insurance only includes the contents that are INSIDE the house

2) Check your landlord's insurance regarding injuries on your rented property. Most people are unaware of the fact that the homeowner is liable in the event that someone is injured on their property. Even if the children across the street climb the fence to get into your yard, you are liable if one of them gets hurt. Find out how your landlord's homeowner's insurance would cover you if someone has an accident.

Tuesday, September 22, 2009

Dr Boyce Watkins: Don’t Kill Tavis Over Wells Fargo

by Dr. Boyce Watkins, Your Black World, AOL Black Voices

When I read about the predatory lending allegations against Tavis Smiley and Wells Fargo, I wasn't surprised. Not because I feel that Tavis is some kind of crook, but because economic downturns are usually when everyone's dirty laundry gets aired out. The high flying 2000s were a decade of extravagance, overspending, easy money and troubled relationships. The party was bound to end. Smiley's party has ended with Wells Fargo, as the company has been accused of using Tavis Smiley and financial expert Kelvin Boston to convince African Americans to sign on to loans that turned out to be predatory. Neither Boston nor Smiley is willing to disclose the amount they were paid for the service, but I'm sure it wasn't chump change.

I've been open and honest in my critiques of Tavis Smiley in the past, but I give credit where it's due. I've always felt that Tavis Smiley is a man who works out of a sincere respect and appreciation for the black community. He is not out to hoodwink, swindle or hurt us, at least not deliberately. At worst, Smiley is guilty of being caught in a situation that he may not have fully understood.

Although I agree with the black community's decision to hold Tavis Smiley accountable for his actions, I want us to be cautious of going overboard in our judgments. Here are 5 things I want to say about Tavis Smiley:

Tuesday, September 15, 2009

Dr Boyce Money: Obama’s Slam to Wall Street

by Dr. Boyce Watkins, Syracuse University

The president recently gave an interesting address to Wall Street on the anniversary of the start of the financial crisis which began last year (and also got him elected). One year ago, the fall of Lehman Brothers left the nation scrambling to find ways to secure critical liquidity to a financial market that was on the brink of devastation.

In his speech, the president wasn't nice. He received applause from the audience only one time, so they don't like him as much as black people do. What's also clear is that he's not President Bush: Wall Street doesn't want Barack Obama to be president, but he is exactly what they need right now.Our banking system is ranked 108th in the world in terms of stability, behind Tanzania. What's even more frightening is that while being incredibly reckless, our banking system is the most powerful in the world, driving the strongest economy on earth. We can't afford to be silly or irresponsible.

The president focused his conversation around three key adjustments:

Thursday, September 3, 2009

Boyce Watkins on ABC News – Love, Money and Sex

by Dr. Boyce Watkins, Syracuse University

I recently appeared on ABC News to talk about Financial Lovemaking, and the link between sex and money. I've discussed relationships and money several times on AOL in the past, but I think that I should quickly lay out some very interesting similarities that may not have crossed your mind. As I teach my Personal Finance Class at Syracuse University this semester, I am reminded that managing our money is linked to managing our love, which is critical to the ultimate goal of effectively managing our lives.

1) Many people think about both sex and money every single day. Don't lie, you know you enjoy thinking about sex, even if you aren't getting any. But chances are, you also think about money, whether it's figuring out how to get what you need or how to keep what you've got. Even most rappers spend all their time talking about either sex, money or how they use their money to get more sex. It's actually a universal concept.

Click to read.

![clip_image001[3] clip_image001[3]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhF1WP4MVuIUfwcZ4TQwvwnVl0l5kUu1xsfCmj9tNuLPfKNDPQwdYC6H4Y6EjJ9ka7SDEv_4NvNf3kR-_hR7O5mgG3Q_1_6pFmHyHdd_4kAldF7mq7M1TBZCXwmO3-9JY1kDAK1vqcBG54/?imgmax=800)

![clip_image003[3] clip_image003[3]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg3pJTBQJv2Ir4GtZer5XBPm9N6_KEH1xKO90wUEEoOhtPqO64xroGeFHTO31bUYX66u7eJWcnJvQkLgMosswYmqm-nZc6w27gP-psedS9HuwwPcXCSr9Z_G4DHjUEJ8tIziglOD4EK2hE/?imgmax=800)